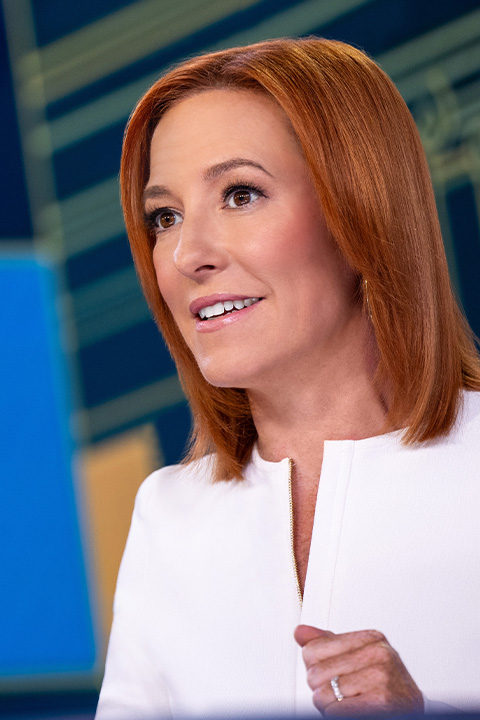

We’re thrilled to share the second episode in our WITHpod 2024: The Stakes series, in which we choose specific areas of policy and talk to an expert about Trump and Biden’s records on the topic. This week, we discuss the candidates’ stances and records on one of the most important and contested topics: tax policy. Kimberly Clausing is the Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law. Before that, she was the deputy assistant secretary for tax analysis in the U.S. Department of the Treasury. Clausing also served as the lead economist in the Office of Tax Policy during the first part of the Biden Administration. She joins WITHpod to discuss Trump vs. Biden tax and economic policy, notable changes in IRS funding, who is most affected by recent major tax legislation and more.

Note: This is a rough transcript — please excuse any typos.

Kimberly Clausing: The Trump administration continued sort of a longstanding lack of interest in adequately funding the IRS and the tax service in general. When we entered the Treasury building on the first days of the Biden administration, you know, we were coming off a long period of underfunding for the IRS and that translates in the American experience into a lot of bad things.

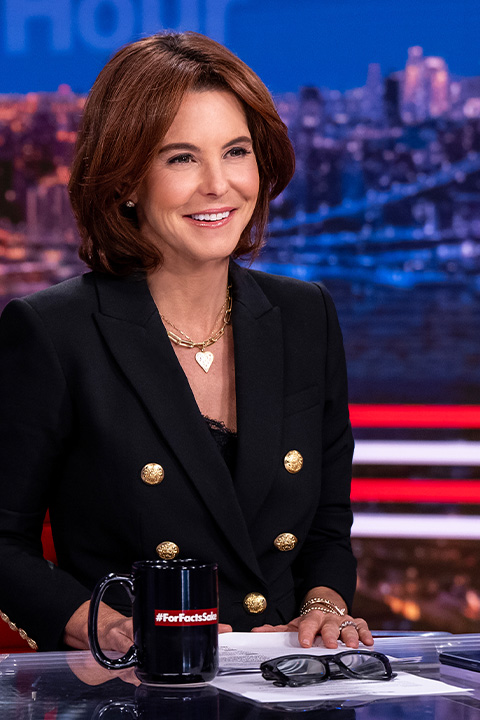

Chris Hayes: Hello and welcome to “Why Is This Happening?” with me, your host, Chris Hayes.

Well, we are here for another edition of this year’s special campaign franchise for WITHpod, “WITHpod 2024: The Stakes,” in which we take a look at the policy records as president of each of the two major party nominees. This year for the first time, since 1892, we have two men running against each other who both served as president, which means they both have records on policy issues. You don’t have to just listen to the campaign rhetoric. You can actually look at what they’ve done.

And today, we’re going to talk about one of the most important things that the government does. One of the most contested sites of distribution, redistribution. One of the materially most important areas of policy, and that is tax policy.

I think it’s fair to say that both of these men have very different views of taxes and what taxes are for, but we can compare what they actually did. And today I thought it’d be a good idea to talk to someone who’s an expert in this.

Kimberly Clausing is the Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law and she actually served in government. She was the Deputy Assistant Secretary for Tax Analysis in the U.S. Department of the Treasury, served as the lead economist in the Office of Tax Policy during the first part of the Biden administration.

Kimberly, welcome to the program.

Kimberly Clausing: Thanks so much for having me.

Chris Hayes: So the setup here is, you know, the first time since 1892, two presidents, two people running against each other, both with records. It’s not speculative. What would they do with taxes? Well, they’ve done stuff with taxes.

So I think the neatest way to divide this into sort of four quadrants, right? So Trump and Biden. And for each of them, I think legislation and then enforcement. So the things that you can only do through legislation, which is things that you sign into law and then things that you do through things like the Treasury Department that don’t necessarily require, but enforcement priorities and things like that.

So let’s just start with Donald Trump. And I think the easiest way to start would be on the one big piece of domestic legislation that he got signed, which was the big Trump tax cuts. What was in the Trump tax cuts?

Kimberly Clausing: Yeah. So, the Trump tax cuts had two major components, a permanent component, which were large corporate tax cuts. They took the statutory rate down 14 percentage points and did a number of things around the tax base as well, but ultimately reduced corporate taxes as a share of GDP to being one of the lowest in the world, really, for the United States.

And the second pillar was a bunch of individual tax cuts. Those are all set to expire at the end of 2025. But those include rate cuts. They include pass-through business income cuts, which are felt on the individual side and estate tax cuts that benefited about two in a thousand estates, the richest two in a thousand.

Chris Hayes: Two in a thousand. Wait, two out of 1,000 estates?

Kimberly Clausing: Yes. So if you’re in the top two tenths of 1% of American estates, then you benefited from the fact that the exemption for the estate tax increased to twice its value. So now there’s about $25 million you can pass on to your heirs if you’re a couple without any tax obligation, where it used to be half that.

So those are the big individual side things. Those are all expiring at the end of 2025. So one of the things that candidate Trump has suggested he would do if re-elected is extend all of those tax cuts. In fact, at some points he talks about doubling down on them and doing even more tax cuts beyond that.

Chris Hayes: Yeah. So, let’s just talk about the individual cuts. So the estate tax, W. Bush did this, too. This is a weird idea fix in Republican policy circles. Even though it’s, I mean, not even though because it’s obvious, because extremely wealthy people who give a lot of money benefit from this, so it’s not like that much rocket science, but tiny, tiny, tiny, tiny slivers of folks so that they can get more money tax free left to them when their parents pass away, basically.

Kimberly Clausing: That’s correct, yeah. So, it’s a little unclear why that’s captured the imagination of the political people who aren’t among the super wealthy. Like why is it that people might vote against, you know, the estate tax is perplexing, a sense it’s such a vanishingly small chance that you would ever have to pay it. So it does seem like something that you would think voters would be in support of letting expire this big estate tax cut.

Chris Hayes: I remember the last time that we had the exact same thing, which is that a big estate tax exemption was put in the Bush tax cuts. It was also temporary. They always do this so that the deficit scoring in the 10-year window is lower.

Kimberly Clausing: Yes.

Chris Hayes: So if you have them expire, it brings down what the score of the total amount that it bust the deficit is. This happened under George W. Bush and I remember Paul Krugman writing a very funny column on what he called the “Throw Momma From The Train” incentive structure, which is that —

Kimberly Clausing: Yeah.

Chris Hayes: — if someone passes away —

Kimberly Clausing: That’s right.

Chris Hayes: — before the expiration, that like twice as much of the estate could be passed on tax free, which creates some obviously very perverse incentives.

Kimberly Clausing: Yeah. It was particularly weird in that case because the estate tax changed gradually and then it disappeared for one year and then it was reinstated as a —

Chris Hayes: Oh, that’s right. It disappeared for one year.

Kimberly Clausing: — much higher level, so you did have this perverse incentive to die in a particular window of time. This one is a little less dramatic than that and it is true that it will, you know, affect maybe one in a thousand estates on the margin. But you have to remember that there’s another slice of the super rich, who probably wouldn’t even feel the difference between those two exemptions because most of it is so wildly north of that.

Chris Hayes: Right, yeah. If it’s billions of dollars, the exemption.

Kimberly Clausing: Yeah.

Chris Hayes: Yeah. Okay, so that’s one part. Who benefited from the rate cuts that might expire?

Kimberly Clausing: Yeah. So the interesting thing about the rate cuts is you might think, well, the top bracket is really the only one that benefits the rich. But if you look at the entire rate structure, because we have a marginal tax rate system, you know, some of your income is going to be taxed at every rate.

For instance, in my case, I have some that’s taxed, but it’s not taxed at all because there’s a big deduction. Then there’s some in the bottom bracket and then there’s some —

Chris Hayes: Right.

Kimberly Clausing: — in the next highest bracket and you kind of go up the bracket. And because of that structure, when you change the brackets, you’re really benefiting disproportionately those at the top of the distribution, even if you’re talking about some of the lower brackets, because the lower brackets, if you’re above them, you get the entirety of the lower bracket at that cut.

Chris Hayes: Oh, I see.

Kimberly Clausing: So you might think, well, this is easy. You’ll just extend the ones below some dollar amount and don’t extend the ones above it, but you’ll still be disproportionately helping the well-off if you take that approach.

Chris Hayes: Right. Because everyone who’s wealthy pays in those lower brackets. But —

Kimberly Clausing: Yes, all of it. Yeah.

Chris Hayes: — right, but not the other way around. So you’re getting whatever the gains are beneath you no matter what.

Kimberly Clausing: That’s right.

Chris Hayes: And then there were other things they did.

Kimberly Clausing: Yes.

Chris Hayes: So the estate tax, the rate cuts, I mean, there was a bunch of stuff. They threw a bunch of things in there.

Kimberly Clausing: There’s a bunch of stuff. I think one of the most troubling provisions was the pass-through business deduction.

Chris Hayes: Yeah, explain that to me.

Kimberly Clausing: Yeah. If you look at that, what it is it sort of says if you’ve got income coming into your individual tax return in business form, which could be partnerships or sole proprietorships or other types of business income that aren’t in C corporate form, but that end up on your individual tax return. If you’re in some industries, but not on others, you get a 20 percent deduction.

So this is kind of an odd incentive that favors some industries over others that is very regressive, because if you look at the benefits from this, a majority of the benefits go to the top 1 percent and the bottom half of the population, I think, only gets 3 percent of the tax cuts. So it’s very, very skewed toward the top. It’s very complex and it’s distortionary.

Chris Hayes: Why do they do this?

Kimberly Clausing: Along with the corporate tax cuts, there was an idea to say, okay, well, what if your business isn’t in C corp form, you should get something too, right?

Chris Hayes: Oh, it sounds like dealing in some group of people.

Kimberly Clausing: Yeah. And so that happened, you know, not at the beginning of the legislative process, but kind of as people started to realize that, well, what about so-called small businesses who are often very wealthy people, but who aren’t in C corp form, they should get something too. And that’s very expensive, it’s about a half trillion dollars to extend that.

Chris Hayes: Half trillion?

Kimberly Clausing: Yeah, over 10 years. Yeah.

Chris Hayes: That’s a huge tax cut.

Kimberly Clausing: Yeah.

Chris Hayes: So it’s a $50 billion a year tax cut for a relatively small group of people that are relatively well-off, is that fair?

Kimberly Clausing: Yeah, I think that’s fair. I mean, of course, there’s going to be some people lower in the income distribution who benefit from it too. You know, like if you have a Uber driver or a salon provider, right?

Chris Hayes: Yep.

Kimberly Clausing: They may also —

Chris Hayes: Yep.

Kimberly Clausing: — get pass-through income deductions, but it’s a complicated provision. I think there are better ways to, you know, redirect resources to people lower in the income distribution who have business activity than to give like this huge windfall across the board.

Chris Hayes: So let’s talk about the corporate tax part of it, which is not temporary. It’s permanent. Although, —

Kimberly Clausing: Right.

Chris Hayes: Donald Trump has said he wants more corporate tax cuts. When you step back and you look at tax policy through the years, that corporate tax cut was enormous. It’s a huge amount of money and corporations are a difficult thing to conceptualize. Like, what does that mean? Who does it go to? Well, it goes to the shareholders. Well, who holds the shares?

Well, teachers and pensioners. But, you know, okay, sure. But are they really seeing the benefit? Like, first of all, describe how big the cut was and what are the effects of it?

Kimberly Clausing: Yeah. So the cut was from 35 percent statutory rate to a 21 percent statutory rate. But one thing to bear in mind is that the biggest companies are really not paying at the statutory rate, in part because they’re operating throughout the world and they can easily arrange their financial affairs, so a lot of the income ends up offshore at a lower tax rate.

But if you look at sort of what it did to taxes received as a share of GDP, we were averaging about 2 percent of corporate taxes as a share of GDP and that fell to the neighborhood of 1 percent due to this agreement. And if you look at the typical rich country, they bring in more like 3 percent —

Chris Hayes: Wow.

Kimberly Clausing: — of the GDP in corporate taxes. Our corporations are some of the most successful ones in the world. If you look at any list of like the world’s top corporations, U.S. has a dominant place on these lists and it disproportionately so relative to the size of our economy. So it seems particularly odd for us to decide to collect so little corporate tax revenue.

Chris Hayes: More of our conversation after this quick break.

(ADVERTISEMENT)

Chris Hayes: There was an argument that was made that sort of went this way, we had one of the highest statutory rates in the world. Other countries, who have lower, even ones we think of as like social democratic countries like France or whatever, now they have very different, complicated and layered tax structures, so they use a bunch of different taxing strategies. Obviously, taxes, a percentage of GDP are much higher in those countries.

But the argument went like this, we have a high statutory rate. The high statutory rate incentivizes gaming the system. I think Apple declaring a bunch of profits in Ireland, because it was sort of a tax haven, all sorts of Caribbean tax havens. If we bring the rate down, that will get rid of distortions. It will incentivize actually corporations paying. I don’t know how much good faith was behind that argument, but that was the most high-minded argument other than we would like to cut an enormous check —

Kimberly Clausing: Yeah. Yeah.

Chris Hayes: — to the owners of capital in America.

Kimberly Clausing: Yeah. No, I agree that that argument is important. I think what gets lost in that argument is that if your competitor is a country with a zero corporate tax rate, taking it from 35 to 20 isn’t going to really dampen a lot the incentive to go to zero. So in fairness, what the Tax Cuts and Jobs Act did, and that’s the name of that legislation, is it did have a minimum tax that applied to foreign income.

But the way it was designed, together with other provisions that were in the same legislation, meant that it really wasn’t solving that profit shifting problem. It was kind of making it worse with one hand and better with the other. And on net, when you look at the data, there was still just as much offshore income after Tax Cuts and Jobs Act as there was before. There was very little diminution in this problem.

Chris Hayes: So that’s what I was going to say. We have the results now.

Kimberly Clausing: Yeah.

Chris Hayes: I mean, there’s a theory about how it would work.

Kimberly Clausing: Yeah.

Chris Hayes: But the results are that it didn’t do that. It didn’t bring profits back on shore.

Kimberly Clausing: That’s right, yeah. I mean, you can find a couple of companies and there’s some marquee tech companies that did move some things off back. But if you look at the aggregate data for the economy as a whole, the pattern looks really similar across the years.

Chris Hayes: So what we know is that argument didn’t, in the aggregate, pan out. The rate really did fall. And crucially, if you just don’t look at the rate, what percentage of taxes, corporate tax per GDP, which is the actual number, right, relative to the size of the economy, fell in half. So relative to the size of our economy, we’re collecting half as much from corporations. What does that mean? Who benefits from that? Again, it all feels very obscure.

Kimberly Clausing: Yeah. So I think economists agree that the corporate tax is one of the more progressive taxes we have in our tax system. There’s a little bit of disagreement about does labor pays some of it, you know. Because we might think, for instance, as you mentioned, there might be people who have shares in their retirement portfolios, but there also might be effects on the capital stock that trickle into people’s wages.

So there may be some effect on labor. We don’t think it’s necessarily zero, but it’s a much smaller effect than you would get from other tax instruments. So if you take your labor income tax, if you take your payroll tax, if you take sales taxes, all of these taxes, labor is entirely burdened by they pay every cent of those taxes.

So even if the corporate tax falls in some measure on labor, which it does a little bit, most of it is falling on capital and on above normal returns to capital. And so it does reach those types of income, which we’re often not taxing at all at the individual level. We’re just completely avoiding taxing it at the individual level. So it’s really our only bite at capital income and so taking so much less tax revenue in that area really reduces the progressivity and fairness of our tax system.

Chris Hayes: I’m just going to translate that like wealthy people who own a lot of stuff.

Kimberly Clausing: That’s right, yeah.

Chris Hayes: I mean, that’s owners of capital.

Kimberly Clausing: Right.

Chris Hayes: If you have big stock portfolio, you have a lot of money, it disproportionately helps them. It would disproportionately favor them. There was a reason that corporate America, as a whole, loved this bill and pushed very hard for it. And they were able to get the votes for it because it was an enormous boon. I mean, a real material improvement to their bottom lines across the board, both in an institutional sense, if you’re, say, Apple. But also in the individual sense, if you’re someone who has $15 million in your portfolio and $5 million of it is Apple stock.

Kimberly Clausing: That’s right. And you see this a bit in the run up in the stock market in the year of that legislation as it gets more and more likely that it’s going to happen. You see the stock market really rising. You see it in big surge in buybacks, record buybacks after the legislation and so the data really confirm your story there.

Chris Hayes: So that’s the Tax Cuts and Jobs Act, that’s a big piece of legislation. It’s the only big piece of legislation. I think the distributional story fairly consistent across these different areas. Like it might have been at the margins decent for all kinds of different people, but by and large, the target of its largesse were the people with the most money.

Kimberly Clausing: That’s right.

Chris Hayes: It benefited the wealthiest the most by far.

Let’s talk about enforcement. You know, this is another place where taxes really matter, how much the IRS is doing, who they’re going after, how much they’re making sure people are paying their taxes. You worked in the Department of Treasury under Biden. Again, this is complicated stuff. There’s literally thousands of civil servants. The IRS is its own sort of weirdly quasi independent body in some ways, as it kind of —

Kimberly Clausing: Yeah.

Chris Hayes: — should be there’s commissioners. But how would you give a top line for the Trump administration’s approach to that?

Kimberly Clausing: Yeah. So, I think the Trump administration continued sort of a longstanding lack of interest in adequately funding the IRS and the tax service in general. When we entered the Treasury building on the first days of the Biden administration, you know, we were coming off a long period of underfunding for the IRS and that translates in the American experience into a lot of bad things for honest taxpayers. It means it’s hard to file your returns. They’re not going to be processed quickly. It means no one’s going to answer the phone if you have a question. It means audits aren’t going to be targeted well, because there’s not the technology to try to tell the difference between honest and dishonest people, so they’re just going to be throwing darts and that’s going to make it more likely that honest people get audited.

And it means that effectively the people who are paying their taxes in full, which is the vast majority of all Americans pay them at full out of their wage income and there’s reporting on that, they’re going to be bearing the burden of funding government services, while those who have opaque sources of income, who choose not to pay in full have a competitive advantage in the marketplace against their competitors, but also are getting away with a much lighter tax burden.

So there’s a big fairness issue here, too.

Chris Hayes: Yeah. If you’re a teacher and you get into W-2 at the end of the year, —

Kimberly Clausing: Yeah.

Chris Hayes: — and you have one source of income, which is your salary, the government knows exactly what you made.

Kimberly Clausing: Yeah.

Chris Hayes: It’s got the form and it deducted.

Kimberly Clausing: Yeah, exactly.

Chris Hayes: There might be reasons that you get money back, depending on some other things about your household, about how the deductions line up. Like, there’s nothing you can really hide, like, they know. The school system told them and that’s true for —

Kimberly Clausing: Yeah.

Chris Hayes: — most workers. Your boss told them exactly how much they paid you. If you have some different vehicles for your income and you’ve got investment capital that you’re then borrowing against and that investment capital is growing, but then you’re borrowing like the more money you are and the further you get from just what is like normie wage income, the more gaming you can do and the more complex your taxes get.

Kimberly Clausing: Absolutely, yeah. And you’ve hit on a huge thing here, which is that this isn’t spread evenly throughout the income distribution. The people who have these opaque sources of income are well-off. And so underfunding, the IRS really serves the interest of dishonest people at the top, rather than your typical worker who would benefit from being able to get their questions answered and getting their returns processed in a quick way.

Chris Hayes: I mean, again, this is a story that’s more than Trump, I should say and a lot of it rests on Congress.

Kimberly Clausing: Oh, yes, for sure.

Chris Hayes: And Jesse Eisinger at ProPublica and others have done great reporting. We’ve actually done a podcast on this that over the years defunding the IRS became a goal of, particularly, Republicans in Congress and were very successful in kind of hollowing out the institutional capacity. We saw a distributional skew in audits, more and more focused to people at the lowest part of the income bracket, including those who get the earned income tax credit.

So like, —

Kimberly Clausing: Yeah.

Chris Hayes: — the poorest folks getting disproportionately audited, which is completely bonkers, rich people getting audited less and less. And partly that was because it was easier to do with less person power. So that was sort of the status quo before the Biden administration. There have been huge changes to the IRS in the Biden administration and to tax enforcement and maybe this is a good place to pivot to that. What has changed in the Biden administration?

Kimberly Clausing: Yeah, so there was a really hard fought effort to get the IRS the resources they needed. This includes both through the typical appropriations process, but importantly, also a big increase in funding that was part of the Inflation Reduction Act that was passed in mid-2022. And if you look at the size of that funding injection, it looks very large, but a lot of it is sort of making up for lost ground in prior years, reductions in the ability of the IRS to do their job, but also investing in things like modernization.

Like if you looked at the IRS, they were relying on ancient equipment, old computing languages. They didn’t have, you know, any of the tools that they really needed to do their job. So this surge in funding enabled them to kind of make up for lost time in terms of all the shortfalls before, but also to give them the technology and tools so that they can maybe have a shot at auditing a complicated situation and not just in earned income tax recipient.

Because part of the problem with being underfunded is you have to focus on things that, you know, basic tax adjusters can look at. You can’t look at the really complicated things. Because looking at the complicated things means that you need higher wage accountants —

Chris Hayes: Right.

Kimberly Clausing: — and people that would be harder to hire. So that also distorts our enforcement.

Chris Hayes: Enforcement has ratcheted up. I mean, I think wait times have gone down. I think there’s a bunch of metrics that show that response times have really gone down, how long people wait on the phone, how quickly they can get someone. So all that stuff you’re talking about institutional capacity, I think that the numbers bear out that that has translated.

But it’s also the case that like my understanding of the numbers are that more rich people aren’t getting audited.

Kimberly Clausing: Yeah. And I think there was a deliberate policy goal of focusing more audit attentions on the groups that had been under audited and completely neglected because of all of this underfunding. So I don’t think you or I or most wage workers would see an increase in audits. And in fact, I think the policy intention has been very clear not to have an increase in audits relative to historic levels for ordinary people.

But to make up for some of this big decline that’s been happening in decades prior where well-off people were able to get away with very little scrutiny. And I think that’s important, not so much only because of the people that you target in this audit, but partly because of the signal it sends to people about behavior. And there can be large deterrence effects associated with the idea that there’s a positive probability. It’s not zero, but there’s some chance that people will hold you to the letter of the law and that’s going to make people more compliant.

And so you don’t have to audit someone to get them to pay their taxes, but you do have to make them think that they might be audited in some world, right? And if they lose the faith, they might be audited in some world, they’re probably going to behave in a less proper way with respect to their tax filings when they have discretion.

Chris Hayes: Yeah. I mean, one of the themes of this series is to try to be very concrete about what government does and doesn’t do and what these two governments have done and where people’s material interests might lie. And I will say that anecdotally, people in finance are getting audited a lot more, sources (ph) and people I know, and they hate it. And they hate Joe Biden because of it.

And again, this is one of these things where I’m sort of like, yeah, man. I wouldn’t like to be audited. I’m sure that’s unpleasant. And this is an actual policy goal and however you feel about that. But the point is that it has been an actual policy change. There have been resources. There is more focus on people at the very top with these more bespoke forms of income portfolios.

Kimberly Clausing: Yeah. And I think if those people, hopefully your friends, are honestly paying what’s due, and auditing doesn’t have to be all that horrible.

Chris Hayes: I only have honest friends.

Kimberly Clausing: Yeah, but I do think it serves their ultimate interests to collect some of the tax gap. Like if you look at how much we’re failing to collect, it’s hundreds and hundreds of billions of dollars a year, right? And everybody’s taxes can be lower if we can fill up some of that tax gap. And if we deter people from wildly understating their income and that ultimately will hopefully make your friends pay less in tax if we can get some of the tax cheats to pay their fair share.

Chris Hayes: We’ll be right back after we take this quick break.

(ADVERTISEMENT)

Chris Hayes: So let’s talk about tax policy here. There was a piece the other day, I forget where it was, in the Times or Wall Street Journal, about the fact that, you know, Biden has been a net tax cutter in his time in office. It’s also the case, I saw some interesting polling the other day that Biden and Democrats have no disadvantage on taxes, which was interesting to me because so much of the Reagan level conservatism was what we call the tax revolt. It was about taxes —

Kimberly Clausing: Yeah.

Chris Hayes: — on liberals and that liberals want to raise your taxes, and conservatives want to cut them, and Democrats raise, and conservatives and Republicans cut. And that was, you know, a real political advantage for Republicans for a very long time. Taxes are not particularly high salience, interestingly, right now in people when they talk about the economy, which sort of includes taxes. They talk about immigration. They talk about democracy and abortion.

But there was a period of time where you asked people this question, like taxes qua taxes would be up at the top.

Kimberly Clausing: Yeah.

Chris Hayes: Remember there’s the American Rescue Plan. There’s the Inflation Reduction Act. There’s a bipartisan infrastructure bill, which I don’t think did a ton on the tax side, although it had to do some for pay-fors. Overall, how would you describe the sort of tax policy side of the law under President Joe Biden?

Kimberly Clausing: Yeah. So I think one thing that your commentary points out is that taxes as a whole are a good issue for him. And I think that’s in part because Tax Cuts and Jobs Act, which is the legislation we talked about earlier was immensely unpopular.

Chris Hayes: Yeah.

Kimberly Clausing: Like people didn’t like it when you cut taxes on those that were better off than them. And many people mistakenly thought that they had their taxes increase in part because their relative tax cut was smaller, right?

Chris Hayes: Well, I had mine increase, it was not a mistake. The SALT deduction was a —

Kimberly Clausing: Oh, that’s real. Yeah. Yeah.

Chris Hayes: — real punch in the face from the Republican Congress.

Kimberly Clausing: And that was quite salient to a lot of people.

Chris Hayes: It sure was.

Kimberly Clausing: So Biden as you know entered office during COVID and kind of during the height of it. You know, like it wasn’t brand new, but Congress was still passing legislation to respond to it. And the first major legislation that was passed was the American Rescue Plan. And that invested in a lot of different responses, including healthcare stuff, including sending money to the states.

But it also changed tax rates for two types of people in a really noticeable way. It expanded the earned income tax credit, which helps workers at the bottom of the distribution by giving them a negative tax rate, effectively. And it made that negative tax rate slightly more generous, but more generous in a way that was really perceptible to some people during that period.

Chris Hayes: Let me stop you right there.

Kimberly Clausing: Yeah, yeah.

Chris Hayes: Negative tax rate, just because that’s a counterintuitive concept.

Kimberly Clausing: Yeah, yeah.

Chris Hayes: The government gives you money.

Kimberly Clausing: That’s right.

Chris Hayes: Yes.

Kimberly Clausing: So like, let’s say you’re a parent with a couple of kids, right? And your first dollar, instead of paying the government some marginal tax rate, you’ll get, you know, 30 some cents back. And so that helps alleviate poverty and provides an incentive for labor force participation. So it’s a really useful tax instrument and I think it legitimately had some support, historically, on both the right and the left, but I think the Democrats have been more keen to expand it.

And the child tax credit was also expanded in a really noticeable way. It was made more generous. It was made payable in a monthly fashion rather than annually. And it was made particularly generous for especially young children who are often more expensive because of child care expenses and there were also improvements in the child care tax credit as well.

So that really invested in children in a noticeable way and drove child poverty down a lot.

Chris Hayes: Yeah. We cut it in half, I think, 50 percent.

Kimberly Clausing: Yes.

Chris Hayes: Let’s stay on the child tax credit because it expired after a year.

Kimberly Clausing: Yes.

Chris Hayes: Again, that phrase, it’s just like I can feel myself like starting to like drift off midway through the phrase and also —

Kimberly Clausing: Yeah.

Chris Hayes: — it feels like opaque, like child tax credit.

Kimberly Clausing: Yeah.

Chris Hayes: What does that mean? What is the child tax credit?

Kimberly Clausing: Yeah. Well, at its most generous level, it was $3,600 a year for young children.

Chris Hayes: That the government gives you back.

Kimberly Clausing: It gives, yeah.

Chris Hayes: Yeah.

Kimberly Clausing: So they just send you $300 a month for having a kid, a young child.

Chris Hayes: Okay, this is a clearer way.

Kimberly Clausing: Yeah.

Chris Hayes: Because one of the things that is very difficult about this is because we do all this stuff through the tax code, right?

Kimberly Clausing: Right.

Chris Hayes: And everything happens through the tax code where there’s pluses and minuses on the ledger.

Kimberly Clausing: Yes.

Chris Hayes: And some things are fully refundable credits and some things are not, right? So some things is you can’t get below zero, right?

Kimberly Clausing: Yeah.

Chris Hayes: There are certain things where you can reduce your tax liability down, but you can never cross over to the government actually giving you money, right?

Kimberly Clausing: Yes.

Chris Hayes: That’s how some things work.

Kimberly Clausing: Yeah.

Chris Hayes: Then there’s a whole other category of things that don’t work that way, where the government can actually give you money. The earned income tax credit is one of them. The child tax credit is another.

Kimberly Clausing: Yes.

Chris Hayes: So to simplify here, because I think it’s really important for people to understand this, that like a tax credit sounds like a $300 check to families with children per child.

Kimberly Clausing: Yeah.

Chris Hayes: Okay, yes.

Kimberly Clausing: Yeah, or $3,600 every year if it’s a young child and I think it’s $250 if it’s an older child. And it was perhaps a mistake to make it temporary.

Chris Hayes: Clearly.

Kimberly Clausing: Because I think that the hope was that it would be so wildly popular that people would rush to extend it and we’d find money to pay for that at that time. But unfortunately, the generosity of the American Rescue Plan version of it did expire. And as it expired, child poverty then increased by a similar amount that it fell.

So it’s a really nice policy experiment for demonstrating the tools that we have to address child poverty. We’ve got this really powerful tool. We know it works. Now, we just need to get the will to use it. And that’s high on the Biden agenda for a second term.

Chris Hayes: So those two programs were expanded. One, the earned income tax credit part of it is still operational, right? The expanded EITC, or did that go away, too?

Kimberly Clausing: There’s still an EITC, but the more generous version also expired.

Chris Hayes: Expired, okay.

Kimberly Clausing: Yeah.

Chris Hayes: No, there’s a bunch of tax implications to the Inflation Reduction Act as well.

Kimberly Clausing: Yes, indeed. So, the Inflation Reduction Act did two types of reductions in costs for Americans. One is change some of the healthcare rules. This isn’t on the tax side, but in ways that would lower prescription drug costs and other healthcare costs for Americans. And another was addressing energy costs and it did this by investing in clean energy. Right? The main goal here was to have a real climate change mitigation strategy that went beyond platitudes involved to actual action.

So there was a whole array of tax cuts for individuals and businesses that we’re investing in clean energy. And so that could be you buying an electric vehicle. It could be somebody installing solar panels, but it also was meant to be much more involved in sort of the electrification of the economy as a whole. Investing in wind, investing in solar, preserving the nuclear power that we do have.

Chris Hayes: Yup.

Kimberly Clausing: Investing in new technologies like sustainable aviation fuel and hydrogen. All of this was meant to be a big response to climate change, but one that, again, is operating through the tax code for the same reason that you might have alluded to earlier, which is that this has to be passed through reconciliation. So you need to do it on the tax side.

Chris Hayes: I was just going to say that, right?

Kimberly Clausing: Yeah.

Chris Hayes: So just so people remember in the Senate —

Kimberly Clausing: Yeah.

Chris Hayes: — the sort of evolution of the de facto filibuster, which itself is a fairly modern creation, creates a 60 vote threshold for all legislation. There is a once a year you can pass one piece of legislation through what’s called reconciliation, which is, well, usually one. Sometimes you can get away with two, but basically one that only has a 50-vote threshold, but it has to be germane to the budget, which means —

Kimberly Clausing: That’s right.

Chris Hayes: — all policy has to be funneled through taxing, basically.

Kimberly Clausing: That’s right.

Chris Hayes: And taxing and spending has to be a budget bill. And things that don’t connect to the budget can be ruled non-germane. They don’t get in. So what you end up with is the climate portion of the Inflation Reduction Act, which is a huge portion, is a tax set of tax packages. It’s a bunch of tax credits and tax incentives that cut taxes and reduce the cost for everyone from consumers to businesses, to investors and everyone that’s, that’s either purchasing or trying to invest into generate more clean energy.

Kimberly Clausing: Exactly. Yeah. And that was the strategy. And, you know, you could imagine, for instance, passing a bill that would simply require the electricity sector to use clean energy, but absent the budgetary impact, you would need a filibuster proof number of senators, right? So it was important to design it in a way that worked through the system that way.

There were also some tax increases in that legislation, too.

Chris Hayes: Yup.

Kimberly Clausing: But those were narrowly focused in the corporate sector on the corporate alternative minimum tax. So that raised a few hundred billion dollars on companies that were reporting a lot of profit but not paying a lot of tax. And then there was a stock buybacks tax too, that also had a small. It was a 1 percent tax on transactions when companies would buy back their own stock.

Chris Hayes: And companies buying back their own stock are a way of increasing shareholder wealth, right?

Kimberly Clausing: Yeah.

Chris Hayes: It’s like a dividend, but not a dividend because the value that’s transferred is not taxable, right? I mean, that’s the whole trick of it, do I have that right?

Kimberly Clausing: Well, it kind of depends. So let’s say you’re buying back some stock. The person who’s actually selling it may trigger capital gains tax, but other shareholders could just hold their shares and decide not to sell. And then they would see the value of their stock rise. So it sort of gives people a moment of discretion where they can either just hold their stock and see its price go up or they can sell it.

But that could trigger in some hands capital gains tax, although it depends on who’s selling it. If it’s a non-taxable entity, then you don’t have to worry about that.

Chris Hayes: I mean, to step back broadly here, we saw under Donald Trump in tax policy, there were some tax cuts across the board in the Tax Cuts and Jobs Act, but much more focused on corporations, which are owners of capital and shareholders, people at the top, the very, very wealthiest estate holders, people that have pass-through income from businesses, focusing on them.

There were, we should note, in the CARES Act and the COVID relief, there were tax cuts, temporary tax cuts for lots of Americans. In fact, you know —

Kimberly Clausing: Yes. Yeah.

Chris Hayes: — tax rebates, that legislation, which was, you know, written basically by Senate Democrats. Well, it was basically was written by Steve Mnuchin and Nancy Pelosi in equal measure. We should note, it did have big tax cuts for a lot of people and distributionally, I think, was actually quite progressive, wouldn’t you say?

Kimberly Clausing: I mean, you know, I think there were aspects of that that were quite progressive, like the stimulus payments that were a flat amount, you know, per —

Chris Hayes: Right.

Kimberly Clausing: — individual, so those are certainly progressive. There were some business things in there too, that’s clearly (ph) —

Chris Hayes: Oh, yeah. There was a lot of business stuff, too.

Kimberly Clausing: — were progressive. You know, like, these provisions I’ve written on separately. So it kind of depends on —

Chris Hayes: I missed that.

Kimberly Clausing: — how you look at it, yeah.

Chris Hayes: But distributionally, I think it would be fair to say that generally Joe Biden has focused on raising tax compliance, and tax rates and tax payments for the wealthiest income earners, —

Kimberly Clausing: Yeah.

Chris Hayes: — as well as corporations, and reducing tax burdens at the very bottom, particularly for families and working families.

Kimberly Clausing: That’s right.

Chris Hayes: And Donald Trump has pulled off the largest corporate tax cut basically in American history. And an enormous tax cut mostly focused or disproportionately focused on the wealthiest taxpayers.

Kimberly Clausing: That seems right. Yeah. I mean, there were some tax cuts for those at the bottom on average under the Trump administration, —

Chris Hayes: Yeah.

Kimberly Clausing: — but they paled in size to the tax cuts —

Chris Hayes: Right.

Kimberly Clausing: — at the top, not just in absolute size, but as a share of income, they were a much smaller share of much lower income.

Chris Hayes: Oh, that’s interesting, say it again.

Kimberly Clausing: Yeah.

Chris Hayes: Because, obviously, in actual size, it’s going to be the case that, you know, if you’re making a million dollars —

Kimberly Clausing: Yeah, of course.

Chris Hayes: — it’s going to be much bigger than someone making $10,000 a year or whatever.

Kimberly Clausing: Right, right. Right.

Chris Hayes: But you’re saying actually is a percentage of income.

Kimberly Clausing: Yeah. So you could see that you’d get more like 3 percent of your income back if you’re at the top, but more like 1 percent at the bottom. There’s some nice distributional tables that analyze this from the Tax Policy Center that showed that distribution quite clearly, but they weren’t alone, you know. JCT, Treasury, anyone who’s kind of looked at the distribution of those tax cuts found that they disproportionately increased the after tax share of income for those at the top. So the relative tax cut was bigger as well as the absolute.

Chris Hayes: Kimberly Clausing is the Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law. She was the Deputy Assistant Secretary for Tax Analysis at the Department of the Treasury, served as the lead economist in the Office of Tax Policy during the first part of the Biden administration and just helped us walk through the complex thicket of tax policy under the two. Although in the end, the sort of top lines, I think, are fairly straightforward and simple.

Kimberly, thank you so much. That was great.

Kimberly Clausing: Great. Thanks for having me.

Chris Hayes: Once again, great thanks to Kimberly Clausing. I would love to hear what you have to say. You can email us at withpod@gmail.com. Get in touch with us using the hashtag #WITHpod across social networks, Threads or Bluesky or X. I am @chrislhayes on all of those. You can follow us on TikTok by searching for me, chrislhayes, or by searching for WITHpod.

“Why Is This Happening?” is presented by MSNBC and NBC News, produced by Doni Holloway and Brendan O’Melia, engineered by Bob Mallory and featuring music by Eddie Cooper. Aisha Turner is the executive producer of MSNBC Audio. You can see more of our work, including links to things we mentioned here by going to nbcnews.com/whyisthishappening.

“Why Is This Happening?” is presented by MSNBC and NBC News, produced by Doni Holloway and Brendan O’Melia, engineered by Bob Mallory and featuring music by Eddie Cooper. Aisha Turner is the executive producer of MSNBC Audio. You can see more of our work, including links to things we mentioned here by going to NBCNews.com/whyisthishappening?