Hurricane Ian was still lashing southwestern Florida on Wednesday afternoon when NBC News meteorologist Bill Karins predicted that the damage and power outages would prevent tens of thousands (if not hundreds of thousands) of Floridians from returning home any time soon.

Ian had winds of only 75 mph Monday, but it intensified rapidly, as Laura and Delta did in 2020 and Ida did last year.

Take it from someone whose house took on 8 feet of water after Hurricane Katrina and who has covered disastrous storms since then: Karins is right to predict a long displacement for people from the hardest-hit areas. He’s also right to implicate climate change as the reason we’re seeing storms hit coastlines with more frequency and strength.

Forecast to reach Florida as a Category 3 hurricane, Ian struck Cayo Costa as a 150-mph Category 4 storm Wednesday afternoon. It was, Karins reported, the fifth-strongest storm to ever hit the continental U.S. Ian had winds of only 75 mph Monday, but it intensified rapidly, as Laura and Delta did in 2020 and Ida did last year.

We’ve been told to expect climate change to cause population shifts, and it’s likely that most people have imagined that such changes will be a function of land washing away or a function of crops and livestock dying as temperatures climb. But that’s not the only way climate change is going to push us around.

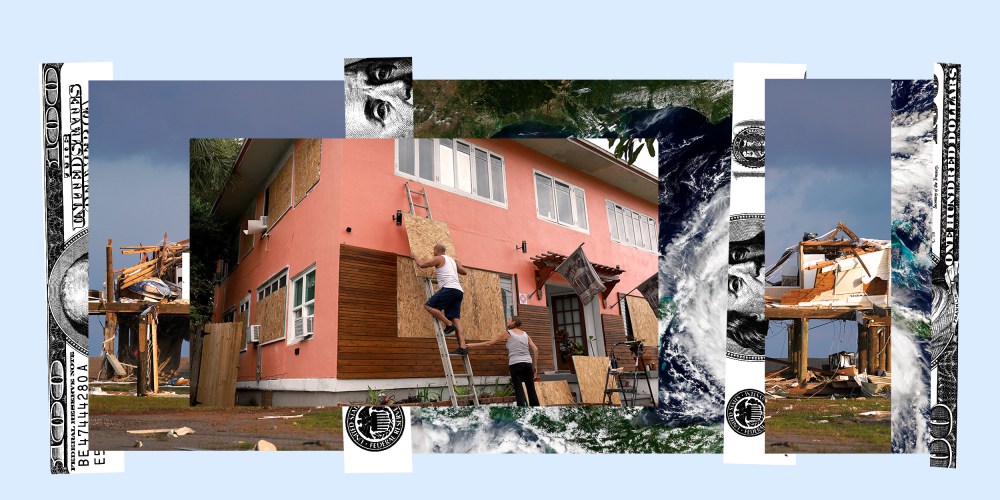

We’re already at the point where financial concerns — including the ability to get mortgages or to insure mortgaged property — are making it harder for some people to stay in the places they love and call home and making it harder for people who might be interested in those places to move there.

During the four years of quiet that preceded Ian’s landfall, a dozen insurance companies evacuated the Sunshine State. Six insurance companies left from February to last week. This leaves Floridians, more than a million of whom have been forced to obtain insurance from a “last resort” state plan, paying almost three times the national average for homeowners insurance.

Unlike Florida, Louisiana was repeatedly hammered by hurricanes in 2020 and 2021. Just like in Florida, insurance companies are falling into insolvency and stranding their policyholders. Last week, Louisiana lost its ninth homeowners insurance company since 2020, the same company that was just declared insolvent in Florida.

State Rep. Jerome “Z” Zeringue told Louisiana’s Houma Courier that he refused to pay the $9,000 premium Louisiana’s “last resort” insurer would have charged. He eventually found a private company that charged him $4,500 — twice as much as he paid before Ida, “and that’s with the highest deductible and bare minimum protection.”

The rates for Citizens, as the state-based insurer is called, are expected to increase by another 63% next year. Eugene Montgomery, who is on Citizens’ board and is an insurance company executive himself, told a reporter for Gannett: “Some people’s insurance payments are going to be larger than their mortgage payments. I’ve been in the insurance business 44 years and have never seen such a challenging market.”