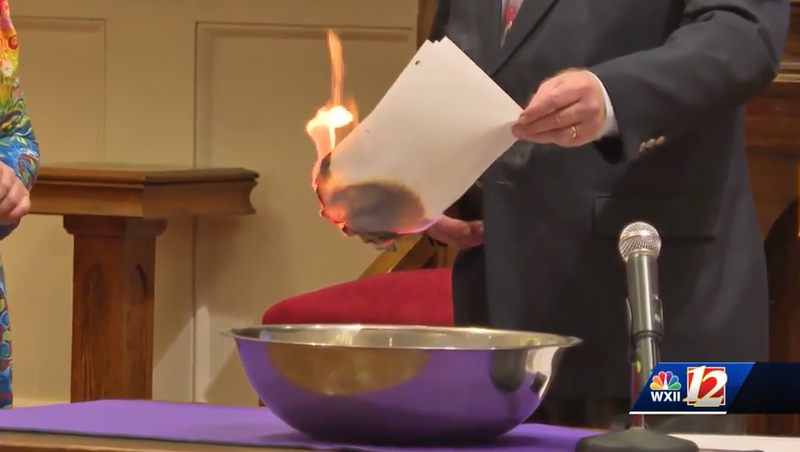

Recently, amid the partisan posturing and Bud Light backlash, a 23-second video of a church congregation burning medical debts went viral on social media. The church, Trinity Moravian of Winston-Salem, North Carolina, collaborated with the nonprofit I lead, RIP Medical Debt, to erase $3.3 million of unpayable medical debt for more than 3,300 people. The church’s donation to RIP, which reflects the cost of acquiring and abolishing the debt, was just $15,000.

How does such a small investment turn into significant relief? By leveraging the for-profit debt market. Like other debts, medical debt can be sold to for-profit entities in bulk, priced at pennies (or less) on the dollar. The debts are sold dirt cheap because the majority are owed by people who simply cannot pay.

The buyer, however, is betting that they can get enough debtors to pay all or a portion of what they owe to make a profit on their investment. The seller (let’s say a hospital) gets to offload debt it has been unable to collect on, for some compensation, and the buyer becomes the owner of a high volume of potential opportunities to collect a profit.

At RIP, we use donor dollars to purchase debt portfolios from health care providers in a similar fashion to for-profit buyers. RIP focuses on those with incomes four times or more below the federal poverty level, or those for whom a debt is 5% or more of their annual income, so we know we’re helping those most financially burdened. But instead of hassling these debtors, we erase unpayable bills and inform them that those debts have been cancelled. On average, just one donated dollar equals $100 of medical debt relief. (For visual learners, here’s a video explainer we put together.)

Last year medical debt represented the majority of all collections on credit reports.

Hospitals that work with us recognize the harm caused by medical debt. They know people don’t get the care they need, experience emotional anguish and make difficult financial decisions because of medical debt. Though 92% of Americans have health insurance, last year medical debt represented the majority of all collections on credit reports. The Kaiser Family Foundation estimates Americans owe at least $195 billion. The real number is likely higher, as KFF’s estimate relies on credit reports; medical debt is often stashed on credit cards — which is then categorized by credit agencies as credit card debt — or money is borrowed from friends and families diffusing and masking the debt in the community.

While the medical debt crisis is dire, there have been positive developments. The top three credit reporting agencies announced changes, co-signed by the Consumer Financial Protection Bureau, that would reduce the financial impact of some medical debts. For example, starting this year, medical debts below $500 can’t be listed on consumer credit reports. At the local level, RIP also has been partnering with counties, cities and states to leverage federal funds from the American Rescue Plan Act to abolish millions in medical debt, starting in Cook County. This approach has been lauded by the White House and will empower us to help millions more people over the next few years.